STRATEGY

The BluPhoenix Advisors' Real Estate Investing Team acquires institutional-quality multifamily assets throughout the United States. We strive to improve our communities through moderate interior and exterior renovations. In addition, our team is experienced in identifying operational inefficiencies which allows us to improve operations to exceed investor expectations.

At Real Estate Investing, We Are Targeting Markets with Strong Apartment Fundamentals and Moderate Cap Rates

Facteurs d'emploi

Strong employment drivers provide stable rental income and lower the risk of the investment by keeping the occupancy rates high.

Contraintes d'approvisionnement

Le sous-marché doit avoir des barrières à l’entrée élevées et une croissance démographique suffisante pour absorber l’offre future prévue de nouveaux appartements.

GDP Growth

Assurez-vous d’éviter les marchés qui sont proches d’une crise potentielle et qui connaissent actuellement des taux de capitalisation extrêmement bas.

MultiFamily Cap Rate Trends

Afin d’atteindre nos rendements annuels préférés pour nos investisseurs, l’économie de la zone métropolitaine doit être très forte.

Tendances de la location multifamiliale

Growing rents serve as an important indicator of a healthy and stable economy with lower associated risk of investment.

Multifamily Occupancy Trends

Des taux d’occupation sains signalent une population croissante qui dépasse l’offre actuelle de nouveaux appartements.

Target Multifamily Markets

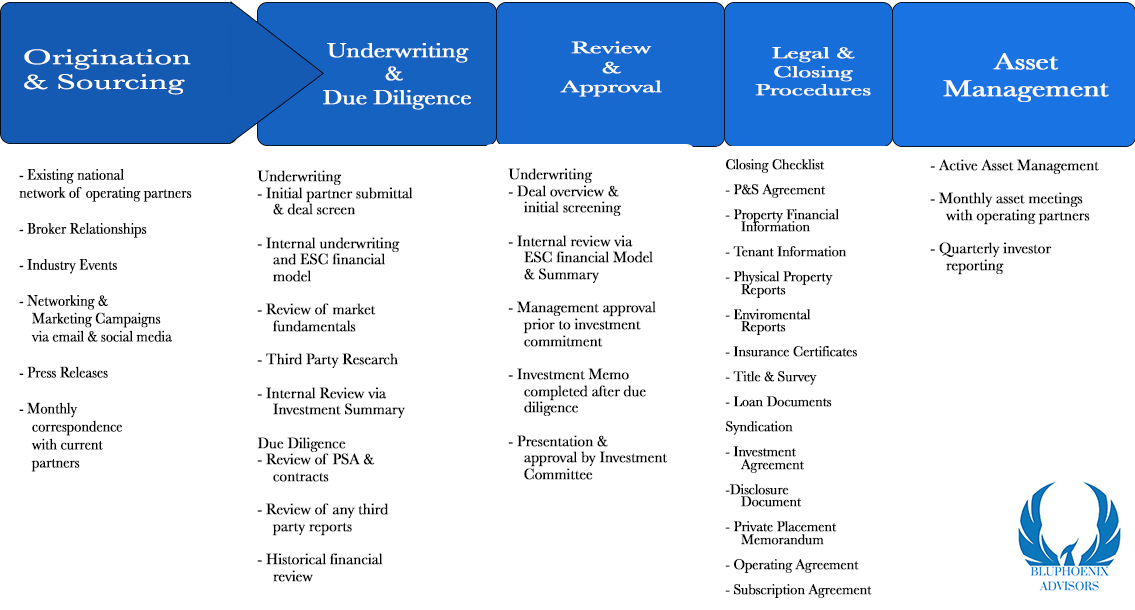

Investment Philosophy

BluPhoenix Advisors se concentre sur l’obtention de rendements attrayants pour les investisseurs tout en maximisant l’appréciation du capital à long terme en investissant selon notre stratégie disciplinée d’acquisition d’investissements immobiliers de haute qualité à un prix d’achat attractif.

Through an intensive research underwriting process along with our strategic partnerships with experienced operators, BluPhoenix Advisors seeks to foster growth and unlock value across our portfolio by focusing on asset management, property operations, leasing, and targeted value initiatives.

Strategic Partnerships

Investissez aux côtés des meilleurs opérateurs de leur catégorie, dotés d'une expertise en matière d'actifs et de marché

Asset & Market Focus

Invest in high quality assets in markets with attractive demographic fundamentals

Acquisitions Fundamentals

Purchase assets at a discount to replacement cost with in-place income

Active Asset Management

Travailler avec des partenaires pour garantir les meilleurs résultats aux investisseurs

Capital Preservation

Focus on investor capital preservation & growth

Tax Benefits

Levered real estate equity ownership

Risks

Economic Uncertainty

Political / International Risks

Affordability

New Supply

Rent Control

Incertitude des taux d'intérêt

Atténuant

Market Demographics

Geographic Focus

Purchase at a Steep Discount to Replacement Cost

High Barrier to Entry Markets w/ In-Place Income

Évitez les marchés avec des lois de contrôle des loyers importantes

Relations bancaires, dette à long terme, taux fixe, couvertures

Opportunités

Strong Demographics

Croissance constante des emplois et des salaires

Strong Demand / Absorption

High Construction Costs

Purchase Below Replacement Cost

Significant Tax Benefits

Best in Class Sponsor Relationships

We bring pride and passion to every project that we undertake, with a professional team of project managers & property managers

ENTREPRISE

SERVICES

CAPITAL RAISE as a Service

HNW TAX PLANNING

ÉVALUATION D'ENTREPRISE

BluPhoenix does not make investment recommendations, and no communication through this website or in any other medium should be construed as such. Investment opportunities posted on this website are "private placements" of securities that are not publicly traded, are subject to holding period requirements, and are intended for investors who do not need a liquid investment. Private placement investments are NOT bank deposits (and thus NOT insured by the FDIC or by any other federal governmental agency), are NOT guaranteed by BluPhoenix and may lose value. Neither the Securities and Exchange Commission nor any federal or state securities commission or regulatory authority has recommended or approved any investment or the accuracy or completeness of any of the information or materials provided by or through the website. Investors must be able to afford the loss of their entire investment. Any financial projections or returns shown on the website are estimated predictions of performance only, are hypothetical, are not based on actual investment results and are not guarantees of future results. Estimated projections do not represent or guarantee the actual results of any transaction, and no representation is made that any transaction will, or is likely to, achieve results or profits similar to those shown. Any investment information contained herein has been secured from sources that BluPhoenix believes are reliable, but we make no representations or warranties as to the accuracy of such information and accept no liability therefor. Offers to sell, or the solicitations of offers to buy, any security can only be made through official offering documents that contain important information about risks, fees and expenses. Investors should conduct their own due diligence, not

Nous vous encourageons à vous fier aux hypothèses ou estimations financières affichées sur ce site Web et à consulter un conseiller financier, un avocat, un comptable et tout autre professionnel pouvant vous aider à comprendre et à évaluer les risques associés à toute opportunité d'investissement.

DISCLOSURE

Securities offered through Avantax Investment Service, member FINRA, SIPC -3200 Olympus Blvd., Suite 100 Dallas, TX 75019. Please refer to FINRA BrokerCheck

L'utilisation de nos produits et services est régie par nos Conditions d'utilisation et notre Politique de confidentialité. Nous ne sommes pas un cabinet d'avocats, ni un substitut à un avocat ou à un cabinet d'avocats.